TransUnion Debt Pull FAQ

GENERAL TU PULL – FAQ

What is the TU debt pull?

Cricket Debt has partnered with the TransUnion credit bureau to allow our clients to pull their debt information into our system so that the client doesn’t have to manually input those debts.

Is this a credit report?

No, this is not a full credit report even though it comes from TransUnion. It is just a list of the client’s debts available from TransUnion.

Who has the option for TU debt pulls?

The TU debt pull is only available to Cricket Debt web clients.

The TU debt pull is not available to waived/waiver requested clients, UrgentCo clients, or Cricket Debt On-Demand clients.

Can both people pull their debts from TU?

No, we only do ONE debt pull per account.

-

- On joint accounts, only one spouse may use this feature.

- We recommend they choose the spouse with the most debts to save the most time.

- They cannot go back and swap to the other spouse.

- Any additional debts can easily be added manually.

Can they swap to the other spouse if they made a mistake?

No, they cannot. That would be the same as two TU pulls on one account.

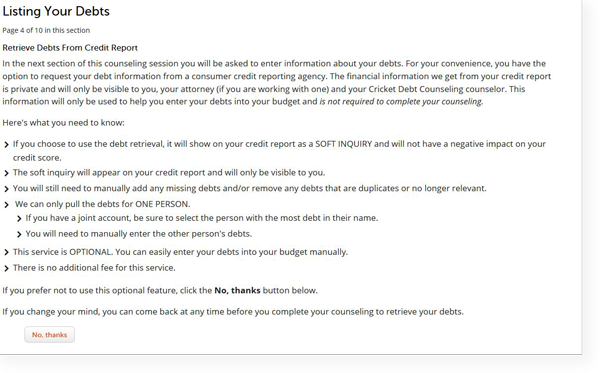

Does a client have to use the TU pull?

No, not at all, it is 100% optional and only meant to help them with the entry of their debts. There is a big button that allows them to skip the pull (see screenshot below).

My client doesn’t want all of the TU debts listed in their counseling account.

By default, all debts are checked but they can uncheck any TU debts that they don’t want to be included.

Some of the debt is miscategorized in our system. Why did TU do that?

TU does not categorize the debt. Our system attempts to categorize the debt based on the information we get from TU, it doesn’t always get it right.

Clients/counselors can always update the information in our system to reflect the appropriate category.

Do I have to move the debt to the right category?

Only if it would make an impact on the recommendation. For example, if the primary vehicle was categorized as an unsecured “other” debt you would need to make it the primary auto debt because that would impact their available cash.

My client says that the TU pull doesn’t list all of their debt.

That’s entirely possible since not every credit agency has access to every debt. The client/counselor will need to manually add any debt that wasn’t included in the TU pull.

My client’s attorney wants a list of the debts from their TU pull

Member attorneys can login to their attorney account, find the client, and view the TU debt list (if the client used the pull). They can also export a copy to use in a spreadsheet.

IMPACT ON CLIENT CREDIT REPORT

What impact does a TU pull have on the client’s credit report?

The debt pull shows as a soft inquiry on their credit report. Soft inquiries are only visible to the client and have no negative impact on their credit score.

My client says they didn’t know that it would show before they chose the TU option

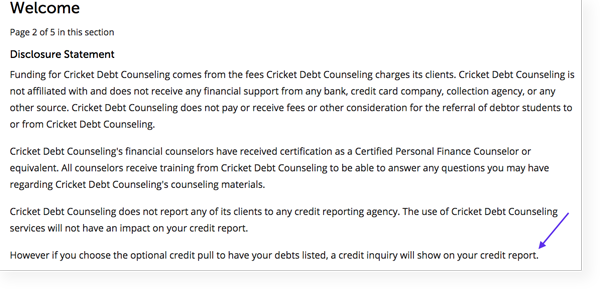

The client was provided this information in our Disclosure Statement:

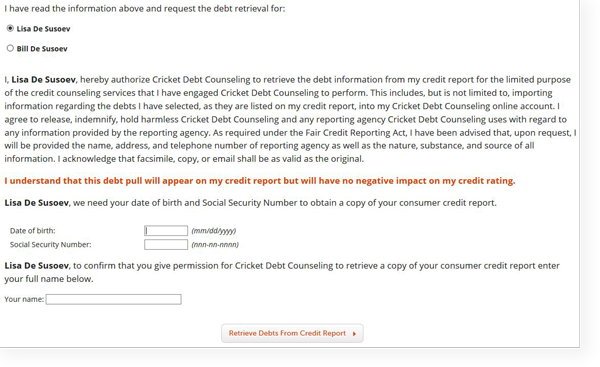

And again when they opt-in to the TU pull:

My client INSISTS that the TU pull shows as a hard inquiry on their report

Any pulls done prior to December 2018 may have resulted in a hard inquiry and that cannot be reversed (keep in mind that our disclosures reflected those terms at that time and the client did agree to those terms).

Please become familiar with the following information and verbiage:

-

- There is no negative impact from TU pulls done after December 2018.

- The client is made aware of the pull showing as a soft inquiry at the time of opting in. (see exact verbiage above)

My client wants us to remove the pull from their credit report.

We cannot do that. Remember, they agreed to the impact on their credit report when they opted-in for the TU pull. We can’t prevent them from disputing it with TU but we will not ask TU to remove the inquiry.